Ethereum Might Be Preparing For A Short-Term Pump Toward $2,400! Here’s What You Need To Know

Ethereum’s trading pattern has become bullish as it aims to break current consolidation, influenced by Bitcoin’s trade within the $43,000-$44,000 threshold following aggressive buying demand. However, in comparison to Bitcoin, Ethereum has shown significant stability after the market downturn, with numerous on-chain indicators now pointing towards encouraging developments.

Whales Gain Confidence Amid ETH ETF Hype

There are compelling reasons to anticipate the imminent approval of spot Ether (ETH) exchange-traded funds (ETFs). Firstly, the U.S. Securities and Exchange Commission’s approval of 11 spot Bitcoin (BTC) ETFs in January 2024 signals a more crypto-friendly stance. Secondly, Ether’s classification as a commodity, favored by experts and regulatory bodies like the U.S. Commodity Futures Trading Commission, makes it a likely candidate for ETF approval due to lighter regulations.

Lastly, strong demand for spot ETH ETFs from both retail and institutional investors, as shown by a Bitwise Asset Management survey, further strengthens the case for their approval.

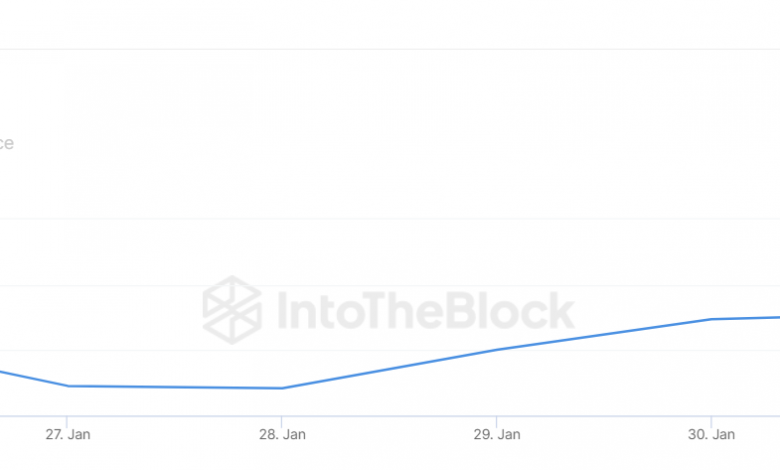

As a result, with ETH set for a potential surge towards $2,400, following Bitcoin’s bullish trend, whales are showing increased interest in its price. On-chain data reveals a consistent uptick in large transactions this week, now hovering at 4.8K. Additionally, recent Ethereum network data shows that Ethereum has re-entered a deflationary phase, with a notable $13 million worth of Ethereum (ETH) being burned in the last 30 days.

This has led to a net supply decrease of 5,619 ETH due to the network’s burning mechanism removing 74,933 ETH, surpassing the 69,313 ETH issued during the same timeframe. This deflationary trend, reducing the available ETH supply, could potentially trigger a price rally, especially if demand remains stable or increases.

With growing interest from whales and surging buying pressure at each support level, the ETH price could be preparing for a short-term surge, potentially challenging buyers’ patience at the $2,400 mark.

What’s Next For ETH Price?

Bulls are attempting to send the price above moving averages but sellers defend the resistance level strongly, resulting in multiple rejections. However, the support is being aggressively defended by buyers. As of writing, ETH price trades at $2,305, surging over 0.49% in the last 24 hours.

Currently, sellers are attempting to keep the price below these moving averages. If they are successful, it could mean that the ETH price might consolidate within the $2,100 to $2,400 range for some time. The nearly flat moving averages and the RSI just around the midpoint also suggest potential near-term consolidation.

However, with ETH price flashing high volatility, there might be a short-term push toward $2,400 and if ETH price holds above that level, we might see a push toward $2,700-$2,900.

If the price fails to maintain above $2,400, bears might gain advantage. This might result in a surge in short-positions, plunging the market sentiment toward support levels.